what happens to my credit score with freedom debt relief?

If you're looking for a mode to deal with your debt, you may be because a debt settlement program. And, during your inquiry, you may notice information saying that information technology can harm your credit score. While this is true in the short-term, in the long-term your creditworthiness is more than just your credit score. For example, decreasing your heavy debt brunt is a primal factor in establishing a non just a better credit score, but also a improve financial time to come.

Then what is the existent touch of debt settlement on credit score? To answer this question, we conducted a four-year written report with help from one of the three leading credit bureaus to discover out what really happens to the credit scores of Freedom Debt Relief (FDR) clients during and after their program.

The results might surprise you.

The study found that once a client completes the Freedom Debt Relief programme, they have:

-

A reduced debt brunt

-

After an initial drop in the outset vi months, clients' credit scores begin to recover

-

A credit score that has recovered to nearly the aforementioned level as it was at the first of the programme

-

Improved financial habits

Read on to go more answers to the seven height questions people ask about the relationship betwixt debt settlement and credit scores.

1. What is debt settlement?

Debt settlement is the process of working with creditors to get them to have less than the amount owed on a debt to consider it resolved. When you piece of work with a debt settlement company (like Freedom Debt Relief), they negotiate with your creditors on your behalf to reduce your debt. Debt settlement companies do accuse a fee for providing this negotiation service, but it cannot be charged up front end, only after y'all have reached a settlement with your creditor.

In a debt settlement program, you:

-

Voluntarily cease making payments on all the accounts you lot enroll which signals to your creditors that you are in fiscal distress and opens up the opportunity to negotiate a settlement

-

Make monthly deposits into a special FDIC-insured savings account, which are used to fund settlement payments to your creditors

-

Review the terms of each negotiated settlement and provide authorization

Equally the debt settlement program progresses, accounts volition go settled one by one, until all of the enrolled accounts have been paid off and resolved.

You May Like These

ii. What happens to my credit score when I begin a debt settlement program?

Making on-fourth dimension payments to creditors is 1 of the well-nigh important factors that affect credit score. When you enroll in a debt settlement programme, in order to be able to negotiate with your creditors, yous will terminate paying on the accounts you enroll. As a result, your credit score can drop during the early months of a program. If you're used to thinking of your credit score as a measure of your financial health, this can seem a footling daunting.

However, after about six months, your credit score tin brainstorm to improve. This is typically the fourth dimension you outset authorizing settlements and when debts brainstorm to go resolved. In addition, our written report showed that the majority of the credit scores of Freedom Debt Relief graduates recovered to where they were at the time of enrollment by the terminate of their program. Recall, your credit score assesses your credit worthiness at a given betoken in time. As the debt settlement process improves your fiscal situation, your credit score can begin to recover.

iii.What is "debt burden" and why does information technology matter?

Debt burden is a more general way of referring to the amount of debt you lot take. One of the most influential variables for credit scores like the FICO® Score is credit card utilization. Credit card utilization is calculated by taking the total outstanding balances on your credit cards and dividing them by your total credit card limits. You lot can then multiply past 100 to go a per centum. The greater your credit card utilization, the higher your minimum payments become. In turn, this tin go far even harder to continue upward with payments for all of your bills.

As a consumer, a high debt burden means that as well much of your income is going to pay off debt. That's money that tin can't be used for things like saving up for a home, a college fund, retirement, or emergency expenses. Even if you can go along up with your debt payments, having too much debt keeps y'all from beingness able to save.

One of the advantages of a debt settlement programme is that, over the course of the program, debt brunt goes downward while credit score recovers. This graph illustrates how this works for Freedom Debt Relief graduates:

FDR Graduates Reduced Debt Burden*

The numbers at the bottom of the graph are months, from the commencement of the program to the end of a 4-twelvemonth plan. In this example, the median Freedom Debt Relief client starts with around $28,000 in debt at the time of enrollment, and that goes down to $three,800, 45 months after enrollment. Meanwhile, the credit score starts at 650, drops to around 500, then gradually rebounds to around 650.

4. Does the Freedom Debt Relief program permanently impairment my credit score?

No. The negative touch on to Freedom Debt Relief clients (who complete the plan) is ordinarily temporary. As stated in a higher place, scores drop in the first months, then outset a steady recovery as settlements are authorized and accounts are resolved through the grade of the plan. Effectually the time of graduation from the program, their credit score is shut to the same as it was when they began.

As you can see in the graph beneath, Freedom Debt Relief graduates enter with a median credit score of 650, experience a drop in credit score in the first 6 months of their programme, and then encounter a rebound in credit score to 648 about the end of their programme, which is typically effectually 48 months.

FICO® Score Recovery

Additionally, it is important to sympathise that negative information will not remain on your credit report indefinitely. Most negative data is removed from your credit written report 7 years subsequently the incident, while some events like defalcation, can remain on your report for 10 years.

5. How can my credit score go upwards if I settle for less than I owe?

2 important factors that impact credit score are credit card utilization and payment history, which together business relationship for 65% of your score. Debt settlement can help improve both of these factors in the longer term. Hither's how:

Credit card utilization

Credit card utilization refers to how much of your available credit you're currently using. For example, if you have 1 credit card with a $20,000 credit limit and your balance is $x,000, your credit carte utilization for that business relationship is 50%. College credit carte du jour utilization tends to be associated with greater credit run a risk and therefore, lower credit scores. Many credit scores have into business relationship credit card utilization across all your accounts.

Payment history (delinquency rate)

On-fourth dimension payments aid your credit score, and tardily or missing payments (called delinquencies) hurt your score. Creditors view late payments as a sign of financial distress, and then when you first first a debt settlement programme and stop paying your creditors, your payment history tin can have a hit, potentially affecting your score. Merely as you progress through the debt settlement plan, and accounts are resolved. those late payments "historic period" and tin can accept less of an bear upon on your score.

Many people considering a debt relief program have a high credit card utilization ratio; this is one reason why many Freedom Debt Relief clients have a credit score below 700 when they outset the program. Over the class of the plan, your credit card utilization should begin to decrease, helping your score recover.

6. What happens to my score later I graduate from Freedom Debt Relief?

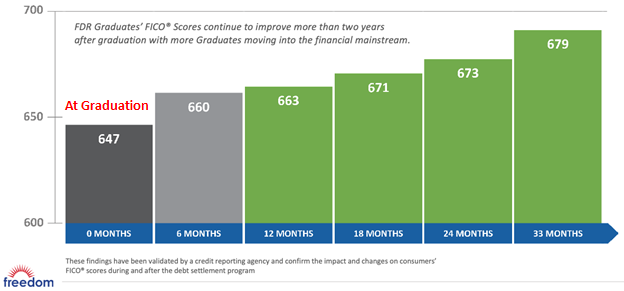

The written report shows that many of the Freedom Debt Relief graduates continued to experience improving credit scores after their fourth dimension in the programme. Here is i more chart illustrating how Freedom Debt Relief graduates' FICO® scores tin continue to get upwardly more than two years subsequently graduation.

FICO® Score Recovery Post Program

vii. What are the other financial benefits of completing a debt settlement programme?

Your credit score changes as your financial situation changes, so the biggest impact on your score in the time to come will be driven by how y'all handle your finances and your debt.

To keep your score as strong as your circumstances allow, make sure you lot sympathize the top five credit score factors, and implement salubrious fiscal habits. Existence a customer in the Liberty Debt Relief program tin help you develop these better skills, as it requires yous to:

-

Make a consequent monthly program deposit building a savings discipline

-

Delay non-essential purchases until y'all have the money to pay greenbacks

-

Reduce or eliminate reliance on credit cards

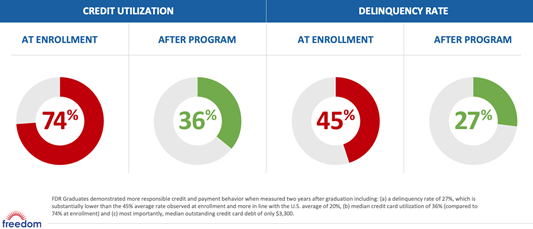

This responsible behavior is oft reflected in graduates' FICO® scores. For case, when the study looked at credit utilization and payment history for clients two years afterward graduation, the median credit utilization dropped from 74% to 36%, and payment delinquency rate dropped from 45% to 27%. This is a great example of the smart debt management habits graduates learn and continue — fifty-fifty years after completing the program. Here is what that looks similar:

FDR Graduates' Responsible Credit Behavior

Debt is a huge financial burden for many Americans, and eliminating it is the start stride to helping build a stronger financial foundation that can serve them for years to come.

Is debt settlement right for you?

The study results we've featured here are based on the median outcomes — results that are in the middle of what was experienced by clients included in our four-year study. Private results vary depending on specific financial circumstances, creditors, and type of debt.

So if you are considering debt relief, we recommend you speak to ane of our Certified Debt Consultants. They'll become over your financial state of affairs with you and assistance you make up one's mind if the Liberty Debt Relief program makes sense in your situation. The consultation is free — and yous tin get started right here.

Larn More

-

Credit Study vs. Credit Score – What's the Divergence? (Freedom Debt Relief)

-

5 Steps to Build Your Credit from Scratch (Liberty Debt Relief)

-

Does Unemployment Touch on Your Credit Score? (Freedom Debt Relief)

-

How to Protect Your Credit Score During the COVID-19 Recession (Freedom Debt Relief)

broussardconevenibary.blogspot.com

Source: https://www.freedomdebtrelief.com/learn/personal-finance/top-7-questions-about-debt-settlement-and-credit-score/

0 Response to "what happens to my credit score with freedom debt relief?"

Post a Comment